An Article by:

An Article by:

Jeffrey M. Hall

A few months ago, new property tax bills were mailed and probably filed away only to be pulled out when those nasty quarterly payments were due. However, the smart taxpayer makes a note on the calendar in October because that’s the time to review the assessment that appears on the tax bill and consider whether it reflects a fair market value for the property. Acting proactively at this time of year can potentially save hundreds, if not thousands of dollars, depending on the size of the assessment and the property’s annual tax burden imposed by the municipality. Many times a property’s total assessment does not accurately reflect the market value of the property assessed. Unbeknownst to many, the New Jersey Division of Taxation publishes something called the Chapter 123 table in October of the pre-tax year. This table establishes the ratio of assessed values to market values for each New Jersey municipality.

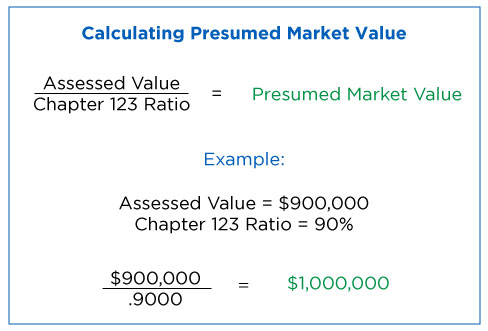

So, now let’s do a bit of math to see what the hypothetical market value of a property should be, based on its assessment. In our scenario, the municipality’s ratio is determined by the assessed values as the numerator and the market values (of selected sales) as the denominator. By simply dividing the resulting Chapter 123 ratio for a particular municipality into a property’s assessment, the equalized assessed value or presumed market value of a property can be determined. For example, if the ratio is 90%, and a property is assessed at $900,000.00, the municipality presumes the market value is $1,000,000.

What’s the value of this information? If your property is worth $1,000,000, the assessment is spot on and you can file your tax bill away. But what if your property is worth only $750,000? Then you should seriously consider pursuing a tax assessment reduction by informal request or a formal tax appeal. Using the same ratio and assessment from above, a property worth only $750,000 should be assessed at $675,000 (not $900,000) and pursuing a reduction should be your next step to avoid paying more than your fair share of taxes the next year.

In our next installment in the Fall into Tax Appeals series, we will explain your options on how and when to file or pursue a property tax appeal.

For more information on tax appeals, please contact Jeffrey Hall of Szaferman, Lakind, Blumstein and Blader, P.C. at jhall@szaferman.com or (609) 275-0400.